This year, we are seeing more stringent requirements from lenders and the underwriting process is more difficult. We just had a lender deny a loan after the buyers had received a pre-approval because the credit score dropped during the process as the over-eager buyers went shopping for new furnishings.

If you’re thinking about buying a home, you need to be aware of your credit score – one of the most important factors when qualifying for a loan. Generally speaking, a higher score can mean a better chance of getting approved for a loan and securing a lower interest rate.

Your Credit Report

Your credit report is a record of money you’ve borrowed, your history of paying it back and how much open credit is available to you. Lenders rely heavily on the information in your credit report as it signifies your creditworthiness and the likelihood that you’ll repay your mortgage.

The following appears on your credit report:

- A list of debts and a history of how you’ve paid them, including credit cards, car loans and student loans.

- Any bills referred to a collection agency, such as utility or medical bills that you did not pay or paid significantly late.

- Public-record information,such as tax liens and bankruptcies that may be linked to you.

- Inquiries made about your creditworthiness, showing how many inquiries were made about your credit and if you were given credit based on the inquiry.

Your Credit Score

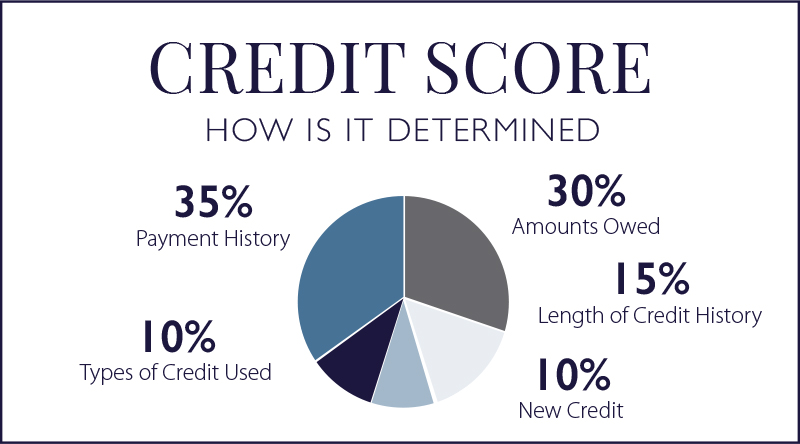

Your credit score helps lenders decide how likely you are to repay your debts and plays a significant role when securing a mortgage. Scores range from 300 – 850 points and are based on:

- Your payment history and ability to repay your debts on time. Late payments will lower your credit score.

- The amount of total debt you owe, including credit cards, student loans and car loans.If your credit cards are at their limits, this can lower your credit score – even if the amount you owe isn’t large.

- How long you’ve used credit and how you’ve managed it. If you show a pattern of managing your credit wisely, keeping credit card balances low and paying your bills on time, your credit score will be positively affected.

- How often you apply for new credit and take on new debt.If you’ve applied for several credit cards at the same time, your credit score can go down.

- The types of credit you currently use,including credit cards, retail accounts, installment loans, finance company accounts and mortgages.

The average credit score is 725. If your score is below 725, you can still get a loan, however you will not have as many options and your rate will be higher.

Other Things to AVOID When Applying for a Mortgage

INCREASE Your Debt Further with Big Purchases

Your home is the biggest purchase you will ever make, and your mortgage company wants to make certain you’re a good candidate for paying back the loan. If you make a large purchase, such as a new car or a boat, right before you apply for a mortgage, the lender will question if you’re financially responsible.

The mortgage company will worry that you have overextended yourself and might have difficulty making monthly mortgage payments. If a lender sees you as a higher risk, you may only quality for a lower loan amount or a higher interest rate.

You want to pay down your debt to get a mortgage, not add more debt.

APPLY for a New Line of Credit

It’s not a good idea to take on any new credit when you are about to apply for a loan. At the stage you don’t need a new credit card or a new charge card. Such moves increase your debt and your debt-to-income (DTI) ratio, and often lower your credit score.

Your DTI is the amount of your monthly debt payments compared to your monthly income. Lenders view a debt-to-income ratio that is higher than 43% negatively.

SPEND Any of Your Savings

Lenders want you to have plenty of money saved for the down payment, closing costs and other expenses incurred when buying a house. The amount of your savings is something that lenders check.

If an emergency happened such as a broken refrigerator, try to buy it with cash instead of using a credit card. At the same time, try to spend as little of your savings as possible to make you seem less of a risk to lenders.

CO-SIGN Any Loans

Although it’s nice to be generous, if you’re ready to buy your first home, you can’t afford to co-sign a loan for a family member. By agreeing to co-sign a loan, you become responsible for paying back the loan if your relative defaults.

This default will appear on your own credit reports and lower your credit scores.

MAX Out Your Credit Cards

Using your entire credit limit increases your debt-to-credit ratio. This is the amount of your credit limit you have used. Keep this ratio below 30% because it’s one criterion lenders use to determine your risk as a borrower.

If possible, stop using your credit card for a while to reduce your overall debt. Focus instead on paying off your balances.

CLOSE Any Credit Accounts

You shouldn’t close any credit accounts you have, even if you haven’t used them in years. By closing an account, your debt is now a higher percentage of your overall credit limit, which reduces your credit score.

Lenders then see you as a higher credit risk. Keep your credit consistent.

Pay Bills LATE

Pay all your bills on time to prove to the mortgage company that you are a good risk. In some situations, a late payment appears on a credit report and this negative item can greatly affect your ability to get a mortgage.

MAKE Major Life Changes

Maintain the status quo during the application process. This means NOT making any major life changes that could affect your income, savings or credit score.

For example, don’t change jobs or take a leave of absence. Lenders want to see stable, long-term employment. Deciding to have a baby, quitting your job and starting a business, or going back to school; These things all cost money and reduce savings.

DEPOSIT Large Amounts without Proper Documentation

If you get a gift from a relative for the down payment, get a gift letter. This states, from the donor, that the money is a gift that doesn’t have to be paid back.

With no financial obligation for this gift, the lender won’t view a sudden large deposit in your bank account as questionable. Include all the required documents regarding this gift with your home loan application.